Page Not Found

Sorry! The page you were looking for is no longer available or the link has expired. If you were looking for a specific product, you can search our store.

While you’re here, take a look through some of our great articles!

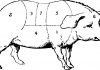

A contrary guide to feeding animals

By Beth Greenwood

Issue #135 • May/June, 2012

The Purinas, Cargills, and Con-Agras of the world would have you believe that they and they alone have...

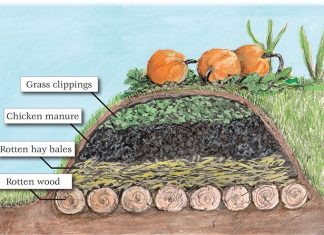

Build an Old-Fashioned Hotbed and Start Your Seeds in Style

By Roy Martin

Issue #104 • March/April, 2007

A hotbed is a miniature greenhouse that is heated to protect new seedlings from cold. The hotbed differs...

Okra — Not Just for the South

By Alice B. Yeager

Photos by James O. Yeager

Issue #58 • July/August, 1999

No one is quite sure about how okra seeds came to this country....

Cheaper than Store-Bought Eggs

By Kristina Seleshanko

Issue #177 • July/August/September, 2019

Something we heard a lot when we first started raising chickens in the suburbs was, “For the cost...

By John Silveira

Issue #35 • September/October, 1995

(This is a four-part series. Click the links to navigate to parts one, two, three, and four.)

Do you think we'll ever have a woman as President?" I asked. "And what would you call her husband the First Husband? The First Man? The...

By John Silveira

Issue #31 • January/February, 1995

"What were you listening to when I got to your house? Sounded nice. I don't think I've ever heard it before."

O.E. MacDougal looked at me from across the table. He's the poker playing friend of Dave Duffy, the fellow who publishes this magazine....

By John Graesch

Issue #64 • July/August, 2000

Sixty five years ago I was living in that part of Seattle, Washington, known as South Park. Few places had as much natural beauty as "The Park" as we knew it. Beautiful lawns and tall shady trees, fruit trees that grew out over...